Award-winning PDF software

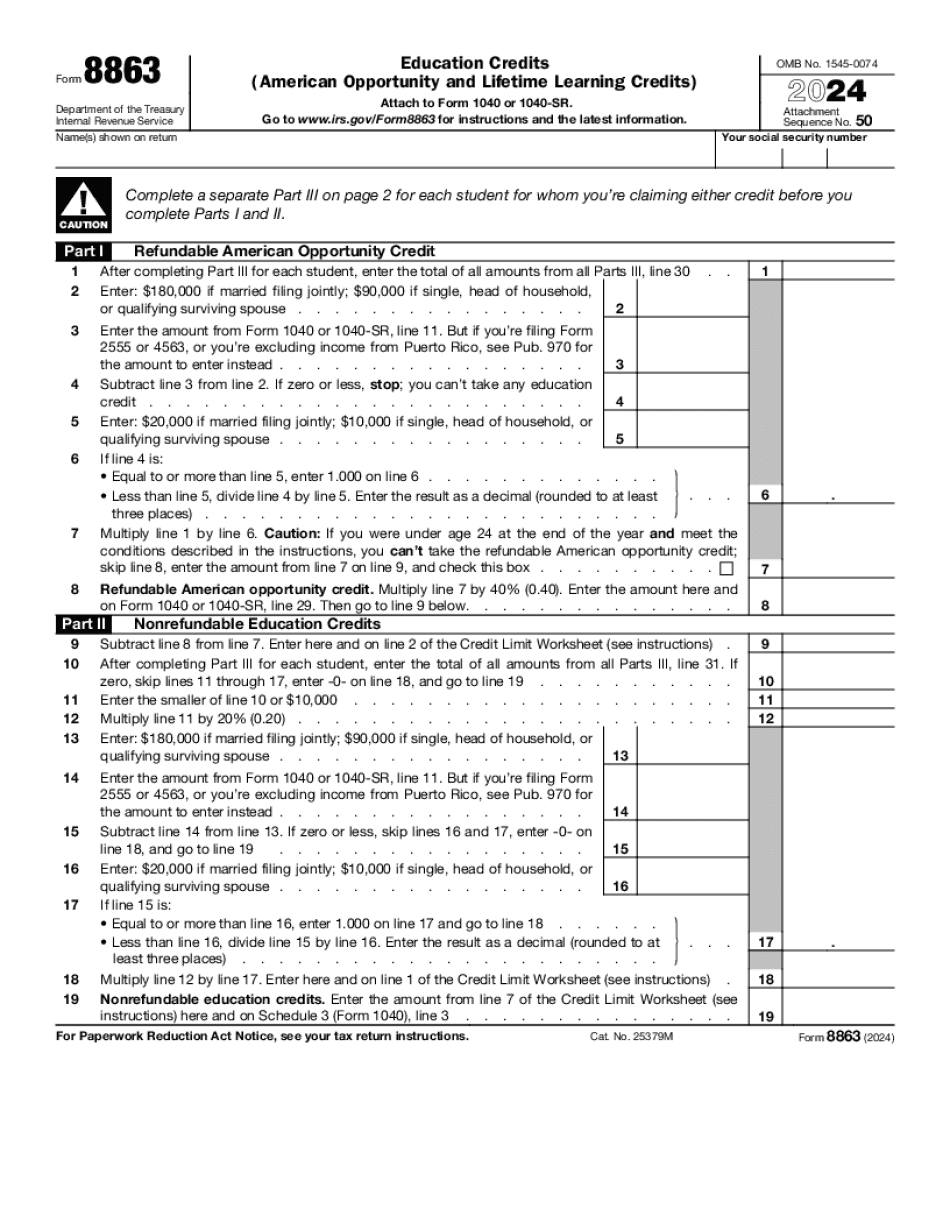

2021 Instructions For Form 8863 - Internal Revenue Service: What You Should Know

IRS Form 8863 (Form 8863-EZ or 8863-Y) — H&R Block The IRS provides free-of-charge electronic filing for the Form 8863. Students can prepare their Form 8863 without the assistance of tax preparers, but must file their tax return over the internet. They can use Form 8863-EZ and Form 8863-Y to document their education expenses. Form 941-W Use Form 3460 to figure and claim your retirement or disability benefit. Form 1040 — Personal and Business Income Tax Return The form includes a series of tabs. Use Form 1040-ES to figure and claim your non-deductible expenses. Form 941-P Use Form 941-EZ to figure and claim your qualified travel expenses. Form 941-X Use Form 941-Y for medical expenses. Form 943-G Use Form 943, Miscellaneous Deductions, to figure and claim itemized deductions. Use Schedule C, Itemized Deductions, to figure and claim your dependent deductions. Use Schedule A, Itemized Deductions for dependent children, to figure and claim exemptions for dependents under age 18. Form 1040 — Self-Employment Expenses Use Form 1040X, U.S. Tax Return for Individuals, with attachments to figure your deductible expenses for self-employment purposes. You may have to include the value of gifts you receive to your income if the value (the fair market value at the time of receipt) is 600. Form 1040 or Form 1040A — U.S. Tax Return for Corporations Both forms require a separate preparation and a separate return.

Online alternatives allow you to to organize your doc administration and increase the efficiency of your respective workflow. Go along with the fast guidebook with the intention to total 2025 Instructions for Form 8863 - Internal Revenue Service, prevent mistakes and furnish it in a very timely manner:

How to finish a 2025 Instructions for Form 8863 - Internal Revenue Service internet:

- On the website with the form, click Begin Now and move for the editor.

- Use the clues to fill out the appropriate fields.

- Include your personal info and call details.

- Make certainly that you just enter right information and facts and quantities in ideal fields.

- Carefully test the subject matter of the form at the same time as grammar and spelling.

- Refer to help section if you have any thoughts or tackle our Help workforce.

- Put an digital signature with your 2025 Instructions for Form 8863 - Internal Revenue Service when using the assistance of Sign Resource.

- Once the shape is completed, press Executed.

- Distribute the completely ready type by means of e-mail or fax, print it out or conserve on your unit.

PDF editor will allow you to make alterations to your 2025 Instructions for Form 8863 - Internal Revenue Service from any online related machine, personalize it based on your preferences, indicator it electronically and distribute in various techniques.