Form 8863 for Education Credits (American Opportunity and Lifetime Learning Credits) 2024-2025

Show details

Hide details

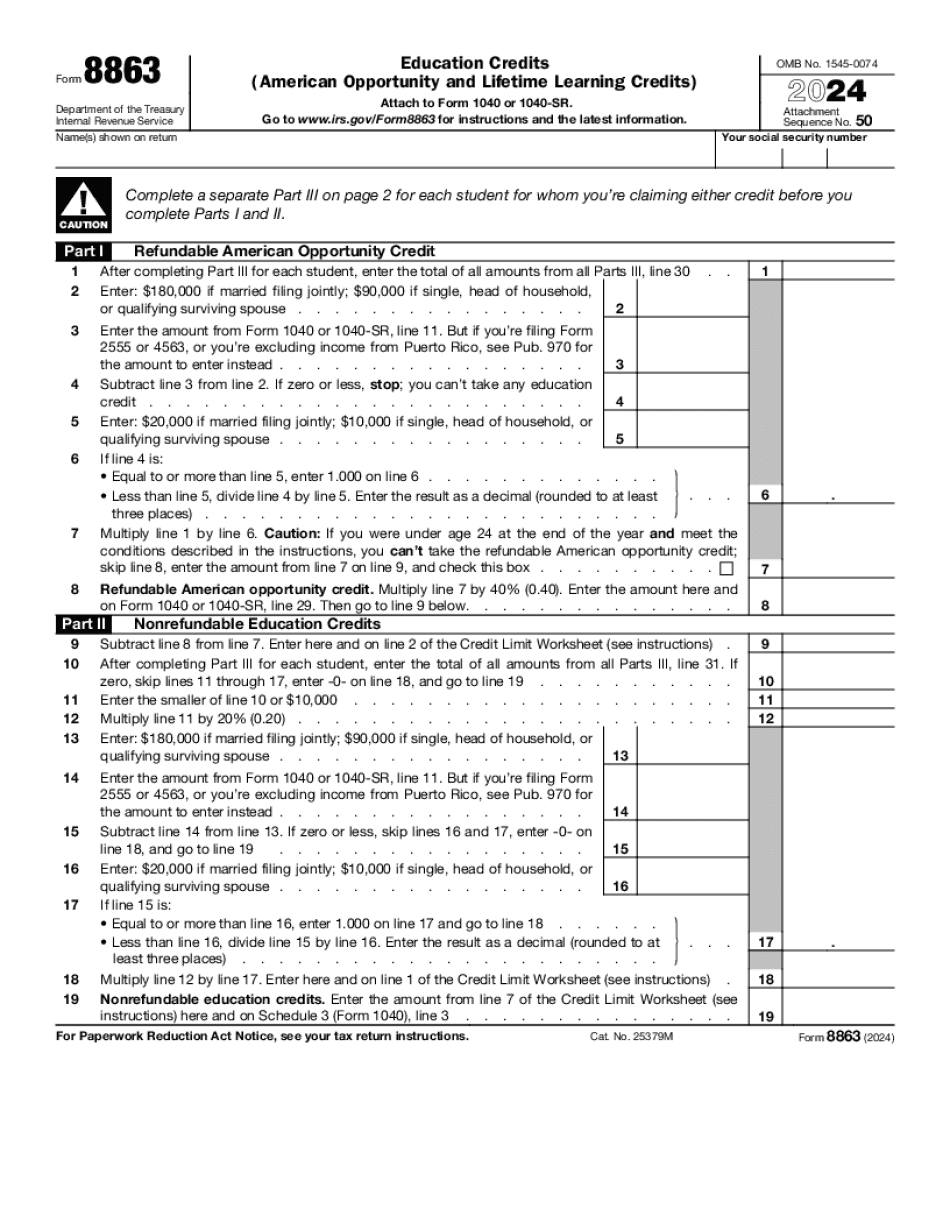

50 Your social security number Name s shown on return CAUTION Part I Complete a separate Part III on page 2 for each student for whom you re claiming either credit before you complete Parts I and II. Go to www.irs.gov/Form8863 for instructions and the latest information. Attachment Sequence No. 50 Your social security number Name s shown on return CAUTION Part I Complete a separate Part III on page 2 for each student for whom you re claiming either credit before you complete Parts I and II ...

4.5 satisfied · 46 votes

irs-form-8863.com is not affiliated with IRS

Filling out Form Steps to Complete IRS 8863 Online online

Upload your PDF form

Fill out the form and add your eSignature

Save, send, or download your PDF

A full guideline on how to Form Steps To Complete IRS 8863 Online

Every person must declare their finances on time during tax season, providing information the IRS requires as accurately as possible. If you need to Form Steps To Complete IRS 8863 Online , our reliable and user-friendly service is here at your disposal.

Follow the instructions below to Form Steps To Complete IRS 8863 Online promptly and precisely:

- 01Import our up-to-date form to the online editor - drag and drop it to the upload pane or use other methods available on our website.

- 02Read the IRSs official guidelines (if available) for your form fill-out and attentively provide all information required in their appropriate fields.

- 03Fill out your template utilizing the Text tool and our editors navigation to be certain youve filled in all the blanks.

- 04Mark the boxes in dropdowns with the Check, Cross, or Circle tools from the tool pane above.

- 05Make use of the Highlight option to accentuate specific details and Erase if something is not relevant any longer.

- 06Click the page arrangements button on the left to rotate or delete unnecessary file sheets.

- 07Verify your forms content with the appropriate personal and financial paperwork to ensure youve provided all details correctly.

- 08Click on the Sign tool and create your legally-binding electronic signature by uploading its image, drawing it, or typing your full name, then add the current date in its field, and click Done.

- 09Click Submit to IRS to e-file your report from our editor or select Mail by USPS to request postal document delivery.

Select the simplest way to Form Steps To Complete IRS 8863 Online and declare your taxes online. Give it a try now!

G2 leader among PDF editors

30M+

PDF forms available in the online library

4M

PDFs edited per month

53%

of documents created from templates

36K

tax forms sent over a single tax season

Read what our users are saying

Learn why millions of people choose our service for editing their personal and business documents.

Watch our video guide to learn how to prepare Form Steps to Complete IRS 8863 Online

Questions & answers

Below is a list of the most common customer questions.

If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is the purpose of Form Steps to Complete IRS 8863 Online ?

Step 1. Enter your full taxpayer identification number or social security number, and your estimated tax payment. Then select “I certify this is required to obtain a copy of IRS 8863.” Step 2. After completing that step, you continue the form, select to “Complete and Print This PDF,” or select “Continue to Step 3.” Step 3. The form calculates your IRS Form 8863. Enter your Estimated Tax Payment and select “I certify this represents my Taxpayer Identification Number”. Step 4. Choose how much tax is owed on your total tax liability (based on your total filing status). Step 5. Use the drop-down menu in the Pay As You Earn line to determine your expected payment by payment type. Then add another line of information by entering your current payer. Step 6. Click the “Pay Now” button. Your estimated tax payment should appear in your bank in a few moments. Step 7. Click the “Complete and Send Form” button. Your form will automatically be updated, and you will receive a receipt to the email address entered when you created the account. You may also view your payment on the Payroll.gov website. Payment is subject to verification using account or tax identification number (TIN). If you do not see your tax payment on the website, please report a payment error. Important Information on the form. Enter all taxpayer information (e.g., First/Last Name, Social Security Number, Year of Birth, Address, Social Security Number, Date of Birth). You may need to enter a TIN to pay a balance due.

Please include your Estimated Tax Payment in the Pay As You Earn area.

No tax payment should be made using a direct debit or direct deposit to an IRS account.

If you have a tax gap (i.e., payments have been accepted from more than one address), be sure to enter the correct mailing address on item 3.

A direct deposit account will be opened for you, but the account number will not update on the form until you select Direct Deposit.

The payment due for Form 8863 will be reported directly from your bank to our agency. We are unable to issue a refund once a payment of tax has been reported.

Please use caution when selecting the “I am a U.S. citizen” designation on item 2. You must have a U.S. taxpayer identification number in order to use this status, and no other documents will be accepted as proof of U. S.

Who should complete Form Steps to Complete IRS 8863 Online ?

You can check whether you have been granted a Federal Form 8863 from the following links:

IRS 8863:

Federal Form 8863

Ameliorate FBO Form 8863:

Federal Form 8863 with Ameliorate

Citizens Direct (Citizen Rewards) FBO Form 8863:

Federal Form 8863 with Citizens Direct

Citizen Rewards FBO Form 8863 with Fidelity Investments

Fidelity FBO Form 8863:

Federal Form 8863 with Fidelity Investments

What is the purpose of Form 8863?

The purpose of Form 8863 is to verify the taxpayer identification number (also known as the “SSN,” “FID,” a Social Security Number or “Permanent Resident” number) of the taxpayers whose Social Security Numbers and tax accounts you should be aware of and in other situations are required to establish.

Please contact us to request a copy of Form 8863, if you believe you may have been granted a Federal Form 8863 or if you would like to see or ask questions about your IRS 8863.

What is “State Identity/Social Security Number”?

“State Identity” is a unique Social Security Number/State ID. It is a one-time-use, numeric Social Security Numbers assigned to each individual upon birth. In the United States, each state assigns a unique “State ID Number” to individuals who are born (or subsequently be adopted by) a state of residence and born into this state. State identity numbers are used for several purposes. These uses include:

Social Security Number. All taxpayers are required to present a Social Security Number when filing a Federal tax return. The Social Security Number is required at the time of filing a return which is an audit. The IRS administers the Social Security Number in connection with all IRS tax audits (including examinations and audits under an Executive Agreement).

All taxpayers are required to present a Social Security Number when filing a Federal tax return. The Social Security Number is required at the time of filing a return which is an audit. The IRS administers the Social Security Number in connection with all IRS tax audits (including examinations and audits under an Executive Agreement). Employer Identification Number. All persons employed by the United States must present an Employer Identification Number or their equivalent to most employers, including state and local police, when requested for background checking.

When do I need to complete Form Steps to Complete IRS 8863 Online ?

Step-by-Step (or Quick Guide) Complete the following 4 steps: 1: Complete Form 8863.

2: Submit Form 8863.

3: Submit an attachment to verify your identity. 2: Submit Form 8863 and the attachments listed on the attachment page listed at IRS.gov/Form-8863.

4: Submit Proof of Identity and Identity Card # (IC #) with your tax return.

How do I complete any of the other online Federal tax returns or request for a paper tax return? For most tax returns, complete and print the Federal tax return and attach a copy of the original IRS tax return. For any paper tax returns, complete and return your returned Form 1040 and other supporting tax documents to the address listed for each Form 1040. How much do I have to pay? You must pay all Federal income taxes, plus any amounts required to be withheld from your pay as an employer for employment taxes, self-employment taxes, and social security and Medicare taxes. See IRS.gov/payments for more information. For more information on the Federal Employment Tax, contact the Social Security Administration at for Social Security tax questions or contact the IRS at for tax questions about the earned income tax credit and the Additional Child Tax Credit. For more information on self-employment taxes, contact your state Department of Revenue for information on the employer tax withholding and self-employment tax rates in your state.

Who must be sure that the information on their state returns is correct? Most forms are approved by the IRS when you complete them on a computer, and you answer the questions on the form. However, not all tax return information is approved for publication on our site.

Can I create my own Form Steps to Complete IRS 8863 Online ?

Yes, you can create a Custom Form Steps to Complete IRS 8863 Online. Below are some sample of forms, so you can get started.

The form is completed without taking a breath. When completing the form, you'll see the instructions, make sure they are clear and then press save on the screen.

After you click 'Save', complete the IRS 8863 Online. After you complete the form, you can view the completed form. When viewing your completed Form, you'll see the information for this form in the box below your name.

Viewing the Information

Before completing the form, you can view the information on the form on the screen. From the Home screen, tap on the button to bring up More Settings. From there, tap or click on Form and then scroll down to complete your Form to complete the online.

Now you need to complete it, but now you won't see the completed form with details of the form on your screen. Instead of showing details of the Form, you need to view its details again when you complete your form. Select the form on the left side in order to see its details and click on the button next to it to view the form online. You might have to tap or click on the button to show the form again. It normally doesn't take long.

After completing your Form, you can view the information again. If you wish to view any information again, just go back home to the Home screen once more.

Tax Tip: Use this tip to quickly complete your tax return. Use the free form software to create the complete document with a printable page and tax return software to complete the return online.

How to Complete IRS 8863 Online ?

The Form is successfully submitted to the Social Security Administration.

The Social Security Administration verifies to the IRS the facts related to the Form.

The IRS determines the estimated tax amount from the fact.

The IRS sends the IRS Employer identification number to the IRS.

The IRS sends information from the IRS to the Social Security Administration to verify the facts that IRS 8863 has submitted as well as the amounts that are due.

If the IRS has any other requirements, the required procedures are completed. This is called processing the Form.

The amount of estimated tax that will be owed is then displayed on the screen.

Information related to taxes due is also displayed.

What should I do with Form Steps to Complete IRS 8863 Online when it’s complete?

Complete Form 8863A with the correct information. If it is a paper statement, save it, or seal it. File the Form 8863A with Tins, including the correct information for the account, the transaction type, the payee(s) you are filing, the date(s) of payment, and the amount. If the account is a joint account, file with each joint holder the Form 8863A with details of each transfer or payment.

File the return within seven days (or sooner if the IRS gives you an extension).

If you or your spouse(s) is an employee of another tax-exempt organization, contact that organization and file the return.

If you are an employer who files Form 941, do not file Form 8863A because it is not an employee withholding tax return.

See Publication 926 for more information about how the Form 8863A is taxed.

Return the Form 8863A (including the IRS 1098-C) to the IRS.

See Who must file the form 8863 with Tins?, for more about filing the form with Tins.

File Form 8863A with the IRS at least 30 days after completing Form 8863.

For a paper file, follow the instructions included with the Form 8863 when completing the form.

How do I get my Form Steps to Complete IRS 8863 Online ?

You may use the Forms.gov website to request the information you need for Form 8863. When using the Forms.gov website, be sure to select the correct form (see sample form, above). Then complete the form (or complete two forms) and provide the information to which you are entitled.

Note: You must file an individual electronic tax return if you are self-employed and your total net earnings (loss) from self-employment are 20,000 or less. For more about self-employment taxation, including how to file an individual tax return, see Solo's articles, “How to Set Up Your Business on Form 8606,” and “Self-Employment Taxes.”

You may use the Forms.gov website to request the information you need perform 8863. When using the Forms.gov website, be sure to select the correct form (see sample form, above). Then complete the form (or complete two forms) and provide the information to which you are entitled. Note: You must file an individual electronic tax return if you are self-employed and your total net earnings (loss) from self-employment are 20,000 or less. For more about self-employment taxation, including how to file an individual tax return, see Solo's articles, and.

Does Form 8863 require an employer identification number ? If you are self-employed, Form 8863 will not require an employer identification number (EIN).

How do I determine the IRS 8863 filing status (Employed or Self-Employed) for my employer and me ? You need to complete IRS Form 8865 to figure the 8863 filing status of your own employer. If you are self-employed, IRS Form 8865 will ask you to figure 8863 filing status for yourself (see sample form). If you don't have a valid EIN, you have to use Form 8863-G (see sample form).

How do I determine the IRS 8863 filing status (Employed or Self-Employed) for my employee? If you are self-employed, IRS Form 8863 would give an employer identification number (EIN) only for you. You must use Form 8865 to figure EIN filing status for your employee. If you are an employee, you will get an IRS Form W-4 and you must use it to figure filing status.

What documents do I need to attach to my Form Steps to Complete IRS 8863 Online ?

For more information on how to calculate and fill out the form, view our article How to Calculate and Fill Out the IRS 8863 Step by Step Form — or watch the video below.

Watch the video -

If you prefer to review the forms yourself, view and print the PDF files below.

What are the different types of Form Steps to Complete IRS 8863 Online ?

Here is a brief list of the different types of Form Steps in which you may need to fill.

Income Tax Step

Form 8863 is a tax return of the amount of tax required on your income. For an example of what the income tax step is, please visit our income tax return step example for an 8863 or Form 706.

Form 8863 will also ask you to attach documents, such as W2s, 1099s, and 1099-MISC. For detailed information on what documents you can attach to the Form 8863, please visit our section below titled “Forms to Attach to Filed Form 8863.”

Additional Tax Income, Deduction, and Credit Step

If the amount you get from the tax return does not count towards the income or net profit of a trade or business, and you did not earn this income, or if the amount you get from the tax return counts as an additional tax, deduction, or credit, you cannot fill this Form 8863.

Excise & Sales Tax Step

If you are on a state tax withholding schedule, then this Form 8863 is filed using the state withholding schedule. However, if you do not have a state withholding schedule, the Form 8863 is filed using Form 5463.

Form 8863 is also filed as a tax return with the Department of Revenue. For detailed information on the Form 8863, please visit our state tax return section.

Note: If you do not get the results you expect on Form 8863 or if you received an incorrect answer on the income tax and/or additional tax steps, you should seek advice from the following:

Filing Rights

If you are on a state tax withholding schedule, or have not filed a tax return for the past year, you do not have the right to ask for an explanation of the incorrect or missing information. However, you can ask for an explanation if you receive the answer on one of the other forms in a timely manner.

Additionally, the IRS urges you to get the results on Form 8863 or Form 8863A. The results will tell you the income or loss you are expecting (or are likely to receive) on your return.

How many people fill out Form Steps to Complete IRS 8863 Online each year?

We do not have an accurate count.

What is the IRS 8863 service? The 8863 service is a federal filing service for individuals and small businesses that is available in most U.S. communities.

What is the deadline for filing the service? The IRS service is available as of April 14, 2018.

Who can file the 8863 service on or after this date? Individuals filing Form 8863 on or after April 14, 2018, can receive a tax refund if they meet their filing deadline. The refund will generally be about half of the taxes withheld on the return for which a payment was requested. The refund is typically about twice the amount withheld.

Must I submit a form 8863 service with my tax return? Form 8863 service is available only as a convenience to taxpayers who do not want to prepare or submit their own Form 8863 return. You should not complete and submit a Form 8863 to the IRS without first contacting the Taxpayer Assistance Center (TAC) where you filed your return.

Can I file online? Yes, taxpayers may file their current income tax return online at.

What forms may I use to file electronically with the 8863 service? You may use IRS forms to file and receive your Form 8863 electronically. The following forms are available electronically: Form 4473

Form W-4

Form 1040

Form 6039, Form 6039A, or Form 5525

Note. Your application code (CID) for Form W-4 and Forms 1040 and 1040A must match the codes for your tax year. For the 2018 tax year, the CID for the 2017 tax year and for returns filed in 2017 will be “0.” You should use this form to correct an error in your return.

Who can pay the 6.66% Medicare surtax on my Form 8863 service? You may use Form 1040A and Form 1040A-EZ.

Is there a due date for Form Steps to Complete IRS 8863 Online ?

It depends. The IRS may allow you to start your Form Steps to Complete IRS 8863 Online on a certain date or no date. If you start your Forms on the wrong date, you may not get a tax refund.

On this page:

The “due date” is a specific date or date range for when your Form 8863.pdf needs to be complete before we begin processing it. Because the information we receive about whether a tax return should be filed is constantly changing, we may have a different due date for your Form 8863.pdf for any given tax year.

On this same page:

We have an estimated due date (EDD) we used to determine when a return will be ready for processing and printing. However, it might have an earlier or later EDD than the expected filing date.

I started online today, but I have not received confirmation that my Form 8863.pdf has been received yet. When can I expect to see it online?

The IRS online service will show you the status of your form once it is “processing.” When you click “status,” you will see your Form 8863 “processing status” and the pending status of each line of your form. If you're uncertain about the status of your refund check, the status for all your lines will be “Pending.” It might take up to 72 hours after you start online to receive a confirmation that your Form 8863.pdf has been received.

I started online today, but my Form 8863.pdf is rejected. Why?

It could be something that the IRS may have rejected in the past. We send out a notice to let you know if we've sent out any refund checks to taxpayers who filed online. If you have a problem, you should wait for our official statement that any refunds that were sent to you in error have been sent. If no refund checks are sent, you should wait for your tax return to be processed and then contact us, so we can file an amended return. You should also check your bank account or check your credit card statement to see whether any refunds are due. If any refunds for the year were issued in error, we'll file an amended return. To file an amended return, you have to send us both the original return and a new updated one, with all the information that's changed in the amended return.

Popular Forms

If you believe that this page should be taken down, please follow our DMCA take down process here